No since the chase sapphire reserve card is a premium card with a long list of valuable benefits chase will not waive the 550 annual fee.

List of chase sapphire reserve benefits.

With the pay yourself back tool your ultimate rewards points are worth 50 more when you redeem them for statement credits against purchases in our current categories.

However by taking advantage of the benefits it is possible to extract more than 550 worth of benefits from the card each year.

Chase sapphire reserve benefits are so rich including rewards perks and protections that it could be considered a bargain even at 550 a year.

You will need to access the official guide to benefits for the card for terms conditions current coverage limits and claim procedures.

Unfortunately these changes did come with an increase in annual fee the reserve now charges 550 per.

We have also abbreviated the coverage descriptions.

You ll earn 7 additional points for each 1 spent when your card is used for qualifying lyft products and services.

5 7 points 7x points on qualifying lyft rides through 03 2022.

Chase is not responsible for the provision of or the failure to provide lyft benefits and services.

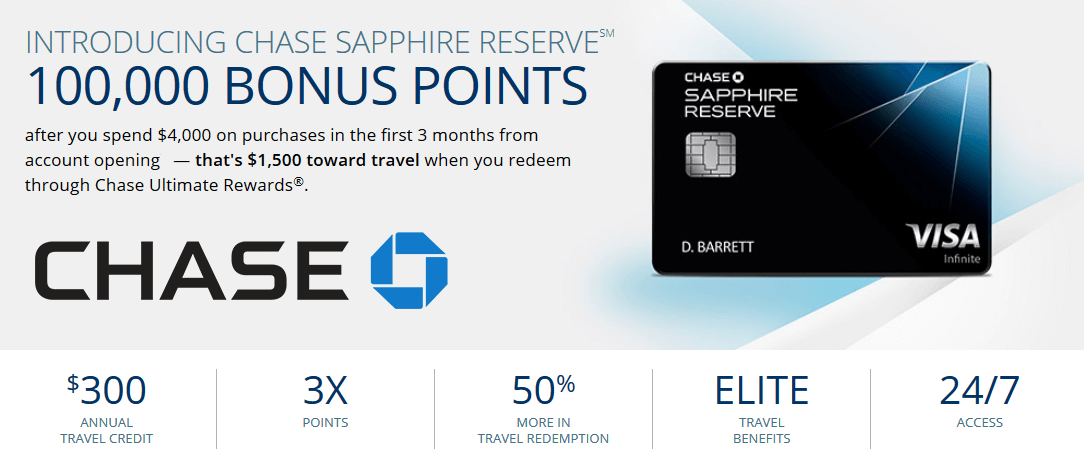

For starters you ll receive a 300 annual travel credit which if you spend that much on travel each year anyway effectively reduces the cost of the annual fee by that amount.

Our list of chase sapphire reserve card travel insurance benefits is an overview only.

Grocery stores and dining at restaurants including takeout and eligible delivery services home improvement stores such as home depot and lowe s and select.

Chase recently announced some major changes to its premium travel credit card the chase sapphire reserve the issuer added new benefits including lyft perks at least one year of dashpass through doordash food delivery service and 60 in annual credits to doordash for the next two years.

The chase sapphire preferred and chase sapphire reserve credit cards will feature new credits and bonus categories through sept.

Last month chase added some temporary new benefits to its two most popular travel cards the chase sapphire reserve and the chase sapphire preferred card all the big travel rewards banks have been adding non travel benefits to make these cards more useful and relevant at a time when travel is uncertain.

Your chase sapphire reserve account must be used to pay for qualifying lyft products and services and be open and not in default to maintain membership benefits.